Investor Guide to Thailand’s Branded Residences (Phuket, Samui, Sichon)

In the last five years, branded residences have become one of Thailand’s most powerful real estate trends. From Phuket to Koh Samui and now to emerging coasts like Sichon — global hospitality names are reshaping the market, creating properties that are both lifestyle havens and high-performing investments.

For international investors and developers, branded residences are no longer a niche they’re a benchmark. Here’s why.

What Are Branded Residences?

Branded residences are luxury homes or condos developed in partnership with global hotel or lifestyle brands like Banyan Tree, Aman, Four Seasons, Rosewood and in Phuket, Botanica, which has become synonymous with eco-luxury living.

They combine:

Luxury design + hotel-standard services

Resort amenities (spas, pools, beach clubs, concierge)

Professional rental management

Global brand recognition that drives demand

For buyers, this means prestige, convenience, and stronger resale value. For developers, it means faster absorption and pricing premiums.

Why Investors Prefer Branded Residences

Price Premiums

Branded projects in Thailand typically command 15–25% higher prices than non-branded competitors.

Faster Absorption

Pre-sales often reach 80%+ within the first year, especially in Phuket and Samui.

Rental Yields

With hotel-style management, branded villas and condos achieve higher occupancy and nightly rates, supporting gross yields of 6–8%.

Exit Liquidity

Stronger resale demand from both local and international buyers.

Phuket: Anchored by Laguna & Botanica Luxury

Phuket remains Thailand’s branded residence capital. In 2024–25:

Botanica Luxury Villas at Laguna → a globally recognised developer of eco-luxury pool villas, positioned alongside Laguna’s golf, marina, and resort ecosystem. Botanica has become a benchmark for international villa buyers in Phuket.

Kamala & Patong → attract ultra-luxury brands like Aman, Rosewood, and Banyan Tree.

Yields: Villas in branded or Laguna-adjacent projects deliver 6–8% gross rental returns.

Koh Samui: Branded Lifestyle & Resort Partnerships

Koh Samui has developed a boutique-scale branded residence market where lifestyle meets yield.

Luxury partnerships with Aman, Four Seasons, and boutique wellness resorts underpin villa demand.

Lamai & Chaweng: Take-up rates exceeded 80% in 2024, with branded projects outperforming resale villas.

Median villa price: ~฿16.9M, with brand-managed properties sustaining premiums.

Buyer profile: European retirees, Middle Eastern families, digital nomads blending holiday and rental use.

Sichon: Banyan Tree Puts the Region on the Map

Sichon is Thailand’s newest branded frontier — and Banyan Tree’s arrival in 2025 confirms it.

Banyan Tree Residences Sichon launched with 15 branded beachfront villas, setting a new standard for the Southern Gulf Coast.

Airport expansion + Samui bridge feasibility are making the area increasingly accessible.

Land pricing remains far below Phuket/Samui, offering first-mover advantag

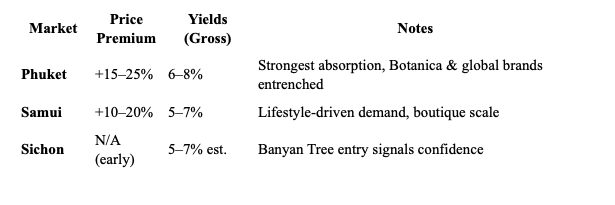

Key Numbers for Branded Residence Investors (2025)

Risks & Considerations

Higher entry prices → Premium pricing means investors must weigh long-term returns.

Management dependency → Rental yields hinge on brand performance.

Foreign quota → Condos capped at 49% foreign ownership.

Market shocks → Tourism-dependent segments remain vulnerable to global disruptions.

What This Means for Investors & Developers

Investors:

Branded residences are Thailand’s safest way to combine prestige + yield + liquidity.

In 2025, Phuket (Botanica/Laguna) is the anchor, Samui is the lifestyle play, and Sichon (Banyan Tree) is the first-mover frontier.

Developers:

Brand partnerships unlock pricing power + global buyer access.

Early movers in Sichon will shape the narrative and benefit from lower land-entry costs.

Final Word

From Phuket’s Laguna Botanica villas to Samui’s boutique branded estates, and now Sichon’s Banyan Tree residences, Thailand’s branded property market is setting new benchmarks.

For investors, this trend offers higher yields, faster absorption, and stronger resale security. For developers, it presents an opportunity to align with world-class brands and tap into global HNW demand